Banking has a long history that dates back millennia. In a bank SWOT analysis, the banking business has developed throughout time, from the days of goldsmiths guarding valuables to today’s digital banking revolution. In this essay, we will delve into the intriguing journey of the banking sector, studying its strengths, weaknesses, opportunities, and threats, as well as emphasizing the significance of a bank SWOT analysis.

History of the Banking Industry

Banking has been a pillar of human society since antiquity. Around 2000 BCE, the first banks appeared in Mesopotamia, where temple priests kept food and other assets for their communities. These institutions eventually evolved into lending and currency exchange facilities.

In the Renaissance era, Italian banks such as the Medici Bank were forerunners of contemporary banking. They pioneered double-entry accounting and letters of credit, laying the groundwork for modern financial systems.

The Great Depression of the twentieth century sparked important banking changes, including the establishment of the Federal Deposit Insurance Corporation (FDIC) in the United States to safeguard depositors. The rise of digital banking in the late twentieth and early twenty-first centuries forever altered the way we handled our finances.

Table of Contents

Bank SWOT Analysis Strengths

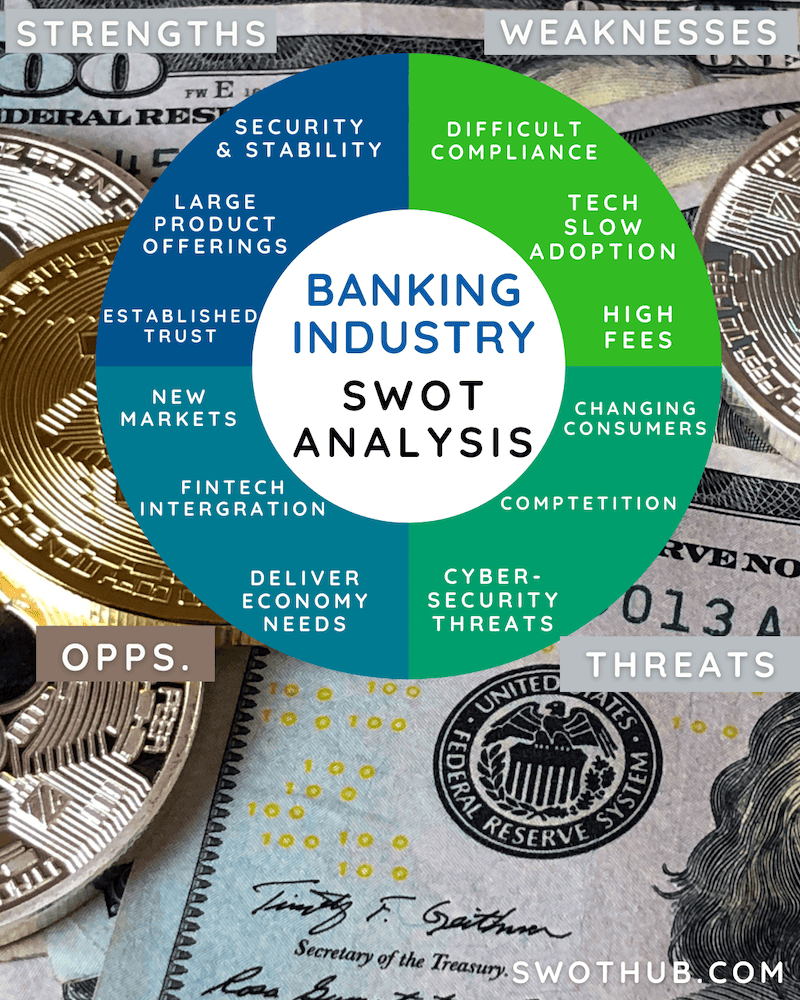

The banking industry has various advantages that have driven it to prominence. In a bank SWOT analysis the industry has many strengths.

Financial Security and Stability: Banks are the foundation of economic stability. Even in turbulent economic times, regulatory scrutiny and deposit insurance schemes safeguard the safety of consumers’ assets. Customers, for example, trusted banks to protect their investments during the 2008 financial crisis.

Large selection of financial products and services: Banks provide a wide range of financial products, from simple savings accounts to complex investing opportunities. This variety attracts a wide range of customers. Retail banks, for example, provide financial services to both individuals and businesses, ranging from personal loans to commercial mortgages.

Established consumer base and trust: Years of service have built consumer trust and loyalty. Relationships formed over time are priceless. Long-term clients who rely on banks for varied financial requirements demonstrate this trust in a bank SWOT analysis.

Bank SWOT Analysis Weaknesses

Despite their strengths, banks encounter a number of limitations that might have an impact on their competitiveness.

Difficult Regulatory Environment: Navigating the complex web of banking laws can be difficult. Banks must constantly adjust to changing regulations, which may be costly and time-consuming. Compliance costs can eat into profits, and regulatory infractions might result in costly fines.

Relatively Slow Adoption of Technological Innovations: While technology has transformed many industries, banks have been slow to adopt cutting-edge solutions. This hesitancy can jeopardize operational efficiency and customer experience, leaving them exposed to competition.

High Fees and Costs: Banks frequently charge fees for a variety of services, ranging from ATM withdrawals to account maintenance. These fees can pile up, prompting some customers to seek alternatives. Furthermore, regulatory monitoring of fees might put banks under pressure to justify their costs.

Bank SWOT Analysis Opportunities:

There are numerous prospects for growth and advancement in the banking industry.

Entry into Emerging Markets: Emerging markets offer banks a plethora of untapped possibilities. In a bank SWOT analysis, they can reach out to unbanked or underbanked people, promoting financial inclusion and boosting their customer base.

Integration of Fintech Solutions: Working with fintech firms allows banks to improve their offerings while remaining competitive. These collaborations have the potential to streamline processes, develop creative solutions, and enhance the entire consumer experience.

Meeting the Digital Economy’s Needs: As the world grows more digital, banks might grab the chance to deliver digital-specific services. Digital payments, internet loans, and blockchain-based solutions are examples of this.

Bank Threats in SWOT Analysis

Various dangers confront the banking business, necessitating vigilant management.

Non-Traditional Financial Institutions Compete: New players in the financial sector, such as tech giants and fintech startups, are challenging traditional banks. They frequently provide creative, user-friendly options that can entice clients away. Banks must adapt to shifting client demands and technological changes in order to remain competitive.

Consumer preferences and expectations are changing. In a bank SWOT analysis, customers today want digital interactions to be seamless. Customer churn can occur if these expectations are not met. Banks must quickly react to changing client demands by investing in technology and user-friendly interfaces.

Cybersecurity Threats: Banking’s digital nature exposes organizations to cybersecurity dangers. A breach can cause reputational harm as well as financial losses. Investing in strong cybersecurity safeguards is critical to protecting both clients and the bank’s reputation.

Bank SWOT Analysis Conclusion and Recommendations:

- Diversify Services: Banks should diversify their product portfolios to meet a broader range of consumer needs by adopting innovative financial solutions.

- Embrace Technology: It is critical to adapt technology innovations quickly in order to improve productivity, cut costs, and meet changing customer expectations.

- Forge Fintech Partnerships: Collaborating with fintech firms is critical to remaining at the cutting edge of innovation and offering cutting-edge financial services.

- Prioritize Cybersecurity: Investing in strong cybersecurity measures is a must to protect customer data and retain confidence.

FAQs for Bank SWOT Analysis

What is the strength of a bank?

A bank’s strength lies in its financial stability, diverse range of services, established customer trust, and compliance with regulatory requirements.

How profitable is the banking industry?

Profitability in the banking industry varies, but it depends on factors like economic conditions, interest rates, and efficiency. Banks aim to generate profits through lending, investments, and fees.

What are the different types of banking business?

Retail banking (for individuals), commercial banking (for businesses), investment banking (capital markets), and central banking (regulating monetary policy) are all parts of the banking industry. Each caters to a different set of financial requirements.